|

|

|

|

sp2

Issue number eight

Volume two

October 2003

www.sp2.uk.com

Venture manpower: as important as venture capital

Since the end of the investment boom in biotech and pharma companies, the raising of venture capital has become more challenging. In addition, pharmaceutical companies’ growth is driven by R&D of new products, which requires more manpower as well as more capital, says Cathrin Pauly of ASPIRAS.

Stock values of pharmaceutical and biotechnology companies used to be preferred investments in 2000 and 2001. The rise of the pharmaceutical index ended in 2001 and the index is now back at the 1998 level. Since the end of the boom, the procurement of venture capital is one of the more challenging tasks in the sector. The amount of venture capital for biotech has decreased by 10 per cent in the USA and by 16 per cent in Europe. In addition, follow-on financing dropped by more than 40 per cent in Europe and 60 per cent in Canada. On the other hand, the USA has seen a more than 10 per cent increase in finance for the sector.

Product ideas have a limited lifetime

Many projects that were launched in the boom time tend to be on the back burner today. Development time is critical in realising the value of new ideas for drugs against certain diseases. The value of the innovation and the commercial value of product ideas decay over time. Therefore it is essential to convert the idea into a marketable product in the quickest way possible.

Extending project schedules due to lack of manpower, which in a certain sense is equivalent to delaying project time, is a risky way to react to actual shortages. The product’s patent protection lasts for 20 years only and if ten years are taken up for time to market, the time available for exploiting the product is not very long. Legal action in patent issues is always a risky game and even big companies sometimes lose those legal actions.

|

|

New products create shareholder value

Meanwhile profit warnings belong to the daily business news. One major reason for these negative messages for shareholders is the lack of R&D outcome. Sales in the pharma market grew by 8% on average worldwide. But sales grew by volume only due to the increasing amount of elderly people. The contribution from new products was quite low. Future commercial success will be determined by the acceptance of the new product within the market.

And the growth and prosperity of a pharmaceutical company depends heavily on new products. Erosion of revenues starts when shelter from patents ends and competition comes in. New political pressure from health care payers welcomes this trend. But how many new products are needed: two, three or five for maintaining a profitable business?

Strategic responses from the pharmaceutical industry were cost cutting and marketing efforts to achieve increased market penetration. The number of sales reps increased by 70% on average. But this is not a remedy.

Mergers and acquisitions are not a real solution

Acquiring new products from biotechnology or even a take-over of an entire biotech company is no longer a viable tactic because prices increased significantly. In addition, there is some doubt about the success of these take-over actions. In the meantime, the traditional situation has been turned around and pharmaceutical companies have been taken over by biotechnology firms. The benefit in these cases was that 70 per cent of the staff in the acquired company were in sales and marketing.

Statistics show that almost half of all mergers and acquisitions end in more severe problems, and that only about 12 per cent of them succeed. The situation is similar in other industries as well. In most cases it is destructive of shareholder value.

Pharmaceutical industry: entering a new era

In the past, the success of the pharmaceutical industry was based on the development and sales of excellent blockbusters. However, the lifetime of blockbusters is shrinking. Although R&D expenditures have increased, the number of approved NMEs has dropped. So why does the increased research and development effort not convert into visible success in terms of new products?

The sector is entering a new era. The number of blockbusters that will generate a billion dollar turnover per year will drop significantly. New products will be needed in smaller niches, and will have to be more focused to the individual problems of the single patient.

With market trends moving to smaller segments of patients, the balance of investigating high-selling and low-selling products has to be reconsidered. The new R&D focus should be to analyse the products in the pipeline, to build clusters and to define individualsed portfolios that work for different patient groups. So the tendency has to be a move away from developing a product and finding the patient for it later. The understanding of disease has to reach a more sophisticated level.

There are drugs that do not work for 30 to 50 per cent of patients, and there are others where this percentage rate is even as high as 70 per cent. Finally, access to the customer will no longer be via the doctor. The trend is towards a direct patient relationship. Currently, most companies look for a better marketing and sales approach. However, the best marketing is a patient-focused R&D strategy.

|

|

Speed up and intensify the development process

If sales of a product drop to 20 per cent when a comparable me-too product comes to the market, the only factor that counts is time-to-market. Enhancement of R&D efficiency can be achieved just by tighter time schedules. However, much better effectiveness is achieved by putting a venture team on those R&D work-packages that tend to be on the critical path. If the threat of an 80 per cent loss is converted into an R&D challenge for an earlier launch date, the money is well invested. This reduces pressure to an acceptable level and definitely increases the prospects for quicker product development.

Extra experienced and qualified manpower is needed for a limited time only. Core competences and intellectual properties can be covered by the company’s internal manpower, while quite an amount of routine work can be performed by the external team. Outside competences with sound experience in the pharmaceutical and biotechnological world are available and lead to quick synergy between internal and external teams.

There is a need for continuous data and quality monitoring right from the beginning in the development period and for closer contact with the regulators. Therefore the emphasis nowadays is more on R&D than on marketing and sales.

The conclusion is that the focus of the pharmaceutical and biotechnology sector should no longer be on venture capital only, it should be on venture manpower as well.

FURTHER INFORMATION

Cathrin Pauly

Aspiras Project Consulting

Am Rosengarten 29

D-55131 Mainz

Germany

Tel: +49 6131995304

Fax: +496131995305

www.aspiras.de

MORE ABOUT ASPIRAS

ASPIRAS offers pharmaceutical consultancy in theory and practice, project management know-how and financial expertise. The company analyses and evaluates specific issues, manages projects and takes care of the implementation of custom-made concepts. The company offers a range of skills in project management, including soft skill aspects, as well the economic evaluation of products and portfolios of products. Support in operations and administration and organisational analysis and business development activities are part of the company’s offering.

FIGURE CAPTIONS

Fig 1. The pharmaceutical index was rising up to the end of 2001 but has now returned to 1998 levels.

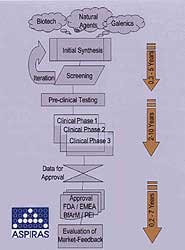

Fig 2. The typical pharmaceutical project consists of many stages, and a delay in any one can reduce the time available for exploiting the product before patent protectin runs out.

Fig 3. The numbers of NMEs being approved has been dropping in recent years. New products are needed for more focussed niches.

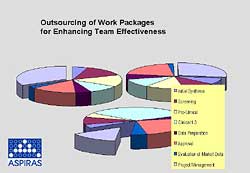

Fig 4. Outsourcing of work practices enhances team effectiveness and reduces project delays.